The Adding Items on a Sales Transaction subtab. For more information about invoice subtabs, see the links in the following list:

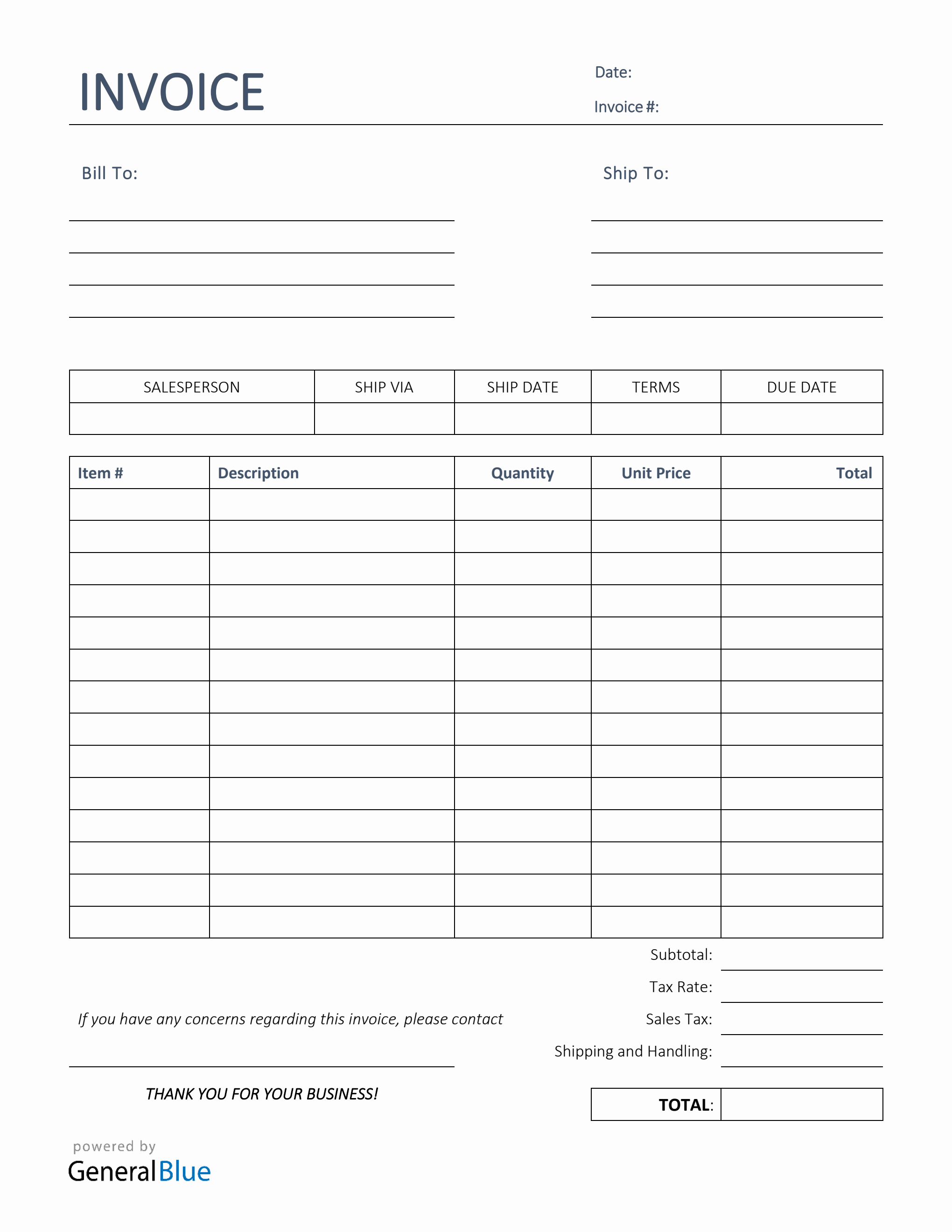

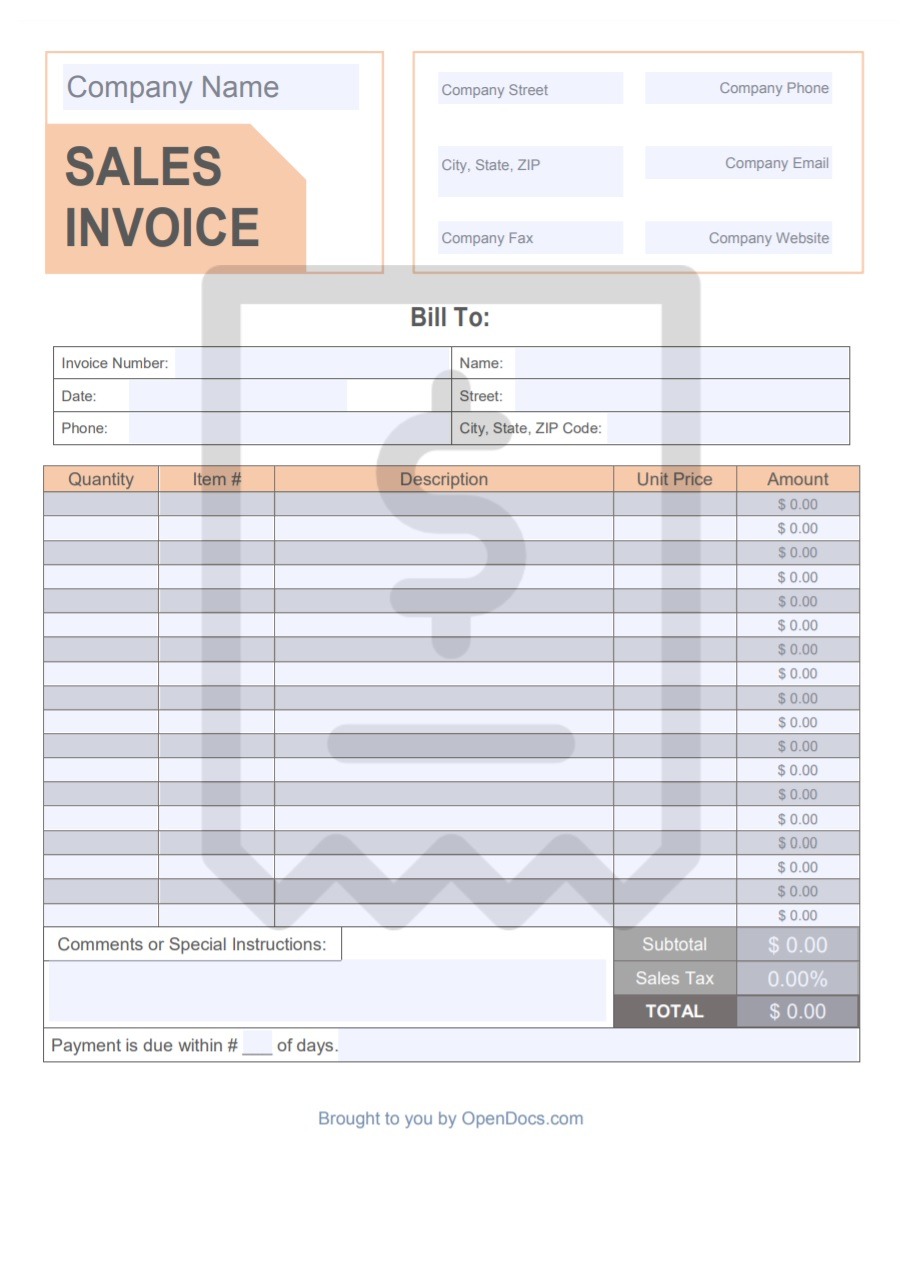

The Invoice page includes several subtabs. For information about sharing customer records with multiple subsidiaries, see Assigning Subsidiaries to a Customer. If you use NetSuite OneWorld and the selected customer is shared with multiple subsidiaries, you can choose any subsidiary assigned to the selected customer. Under Classification, select a department, class, or location to associate with the invoice. For more information, see Associating Partners With Customers and Transactions. If you have enabled the Multi-Partner Management feature, you can associate partners with this transaction on the Partners subtab. The partner associated with this customer appears in the Partner field. If you use Marketing Automation, select the campaign you want to associate with this transaction’s revenue. In the Lead Source field, select the source of the lead for this invoice. For example, selecting this box on a sales order excludes the sales order and the resulting invoice from all commission calculations for all sales people. The sales effective date determines which commission plan and historical sales team this transaction applies to.Ĭheck Exclude Commissions to exclude this transaction and its subordinate transactions from inclusion in all commission calculations. You can change the sales effective date for this transaction. In the Opportunity field, select the opportunity associated with this invoice. For more information, see Associating Sales Teams with Customers and Transactions. Select the sales team for this transaction. If you use the Team Selling feature, click the Sales Team subtab. The sales rep or sales group associated with the customer on this transaction is chosen by default. If you do not use the Team Selling feature, select the sales rep or sales group in the Sales Rep field. Select the sales reps associated with this invoice.Īssociate sales reps with this transaction in one of the following ways: When you use the Search Transactions feature, you can search for specific words and phrases in the Memo field. In the Memo field, enter a memo to identify this invoice. In the PO# field, enter any customer purchase order number associated with this invoice. In the Due Date field, enter the invoice due date. If you use accounting periods, select the posting period for this invoice. In the End Date field, enter the date this invoice is no longer valid. In the Start Date field, if you use Advanced Billing, enter the creation date for the first invoice. There might be extra rules depending on the amount the invoice is for.įind out what you need to include on a GST invoice on the Australian Taxation Office (ATO) website.If you later edit the date on an invoice, the new date also becomes the due date, whether the due date value was previously set. For example, you must state on the invoice that it's a 'tax invoice' and include the GST amount. You must include certain information to create a valid tax invoice for GST. customer's purchase order (PO) number or contract agreement dates.name of the person who will pay the invoice (this can help speed up payment).name of the person who placed the order.customer's contact details such as postal address, email address and phone number.When invoicing a customer, it's standard practice to include the: direct banking details, including BSB and account number, account name, the name and branch of the bank and the reference number to be included in the transaction description.

options, such as direct deposit, credit card, EFTPOS and cash.terms – for example, the number of days before payment is due, the final due date or a discount for early payment.goods and services tax (GST), if it applies.itemised description of goods and amount due.

Sales invoice example code#

0 kommentar(er)

0 kommentar(er)